IAPH develops its own GHG performance indicator

NewsIAPH’s GHG performance indicator will apply the same ship data reported to IMO, also aligning vessel audit frequency to a yearly basis.

The new regulations have hampered non-eco vessels’ ability to speed up during robust markets, unlike eco vessels, thus widening the profit for modern vessels.

The integration of the Energy Efficiency Existing Ship Index (EEXI) and Carbon Intensity Indicator (CII) regulations, alongside the Emissions Trading System, seems to have indirectly restricted the availability of shipping tonnage by impacting vessel speeds.

Analysis of vessel tracking data, recently published by Intermodal‘s Yiannis Parganas, Head of the Research Department, reveals a noticeable decrease in the average speed of bulk carriers, reaching a current low of 10.86 knots.

Notably, non-eco vessels have been more significantly affected by these regulations, aimed at curbing their carbon emissions.

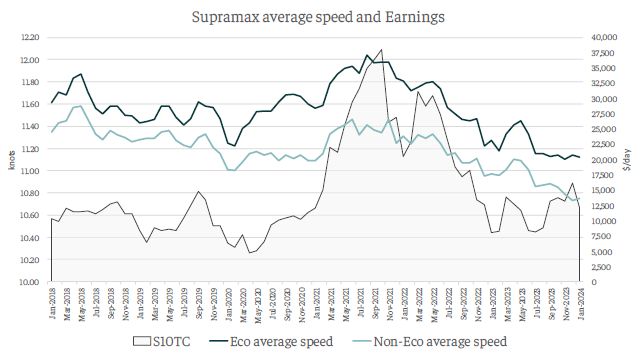

This report comprehensively analyzes the Supramax sector, focusing on the trend depicted in the accompanying chart, which indicates a decline in the speed of both eco and non-eco vessels following the peak in mid-2021.

Despite occasional spikes correlating with increases in the S10TC, both categories have hit their lowest recorded speeds.

Remarkably, this trend persisted beyond mid-2023, despite an increase in earnings.

While eco vessels exhibited relative stability in their speeds during the latter half of 2023, non-eco vessels experienced a negative correlation between S10TC and speed, declining from mid-year despite improved earnings, remaining below the 11 knots threshold.

On the other hand, eco vessels, although with a slightly negative correlation, maintained an average speed of 11.15 knots in the latter half of 2023 as earnings improved.

Additionally, the speed gap between eco and non-eco vessels now surpasses the five-year average during a period typically showing the smallest yearly difference, coinciding with a traditionally subdued market in Q1.

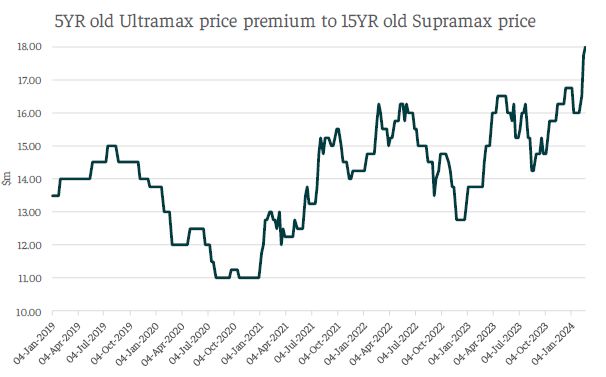

The new regulations have hampered non-eco vessels’ ability to speed up during robust freight markets, unlike eco vessels, thus widening the profit margin for modern vessels.

This is evidenced by the premium of a 5-year-old Ultramax vessel over a 15-year-old Supramax, currently at a record high of $18.0 million.

These regulations offer owners of modern vessels greater operational flexibility at higher speeds in stronger freight market conditions, contrasting with owners of older vessels compelled to adopt a more conservative strategy.

The scarcity of offered modern vessels in the secondhand market further contributes to the observed premium.

Overall, the operation of both eco and non-eco vessels at their lowest recorded speeds, down by 7.8% and 7.3% respectively from their five-year highs, and 4% and 4.4% from their five-year averages, not only plays a crucial role in fostering a favourable freight market environment but is also likely to continue influencing interest in the SnP market.